MoCaFi hit the ground running in California during COVID-19, partnering with the City of LA to launch the Angeleno Connect program. Angeleno Connect aims to provide residents with contactless access to cash benefits, low-fee mobile banking accounts, and financial tools and resources. Since then, MoCaFi’s payments platform has been utilized by multiple government and non-profit entities across the state.

MoCaFi in California (2020 – present): At a Glance

- Dollars disbursed: $130 Million

- Number of locations: 5 (Los Angeles City and County, San Diego, San Francisco, and Pomona):

- Immediate Response Card accounts opened: 25,000+

Solving a benefits pain point for disbursing entities and unbanked communities

An estimated 18% of households, or 2.5 million Californians, are unbanked and spend hundreds of dollars annually on banking fees. For those receiving benefits, these fees eat into money they could be spending on rent, food, or other necessities. Paper checks cost governments as well. As a recent Executive Order highlighted, it costs a disbursing entity more than double the cost to issue a paper check vs. a digital payment. Paper checks are also more vulnerable to fraud and theft and have a higher administrative burden.

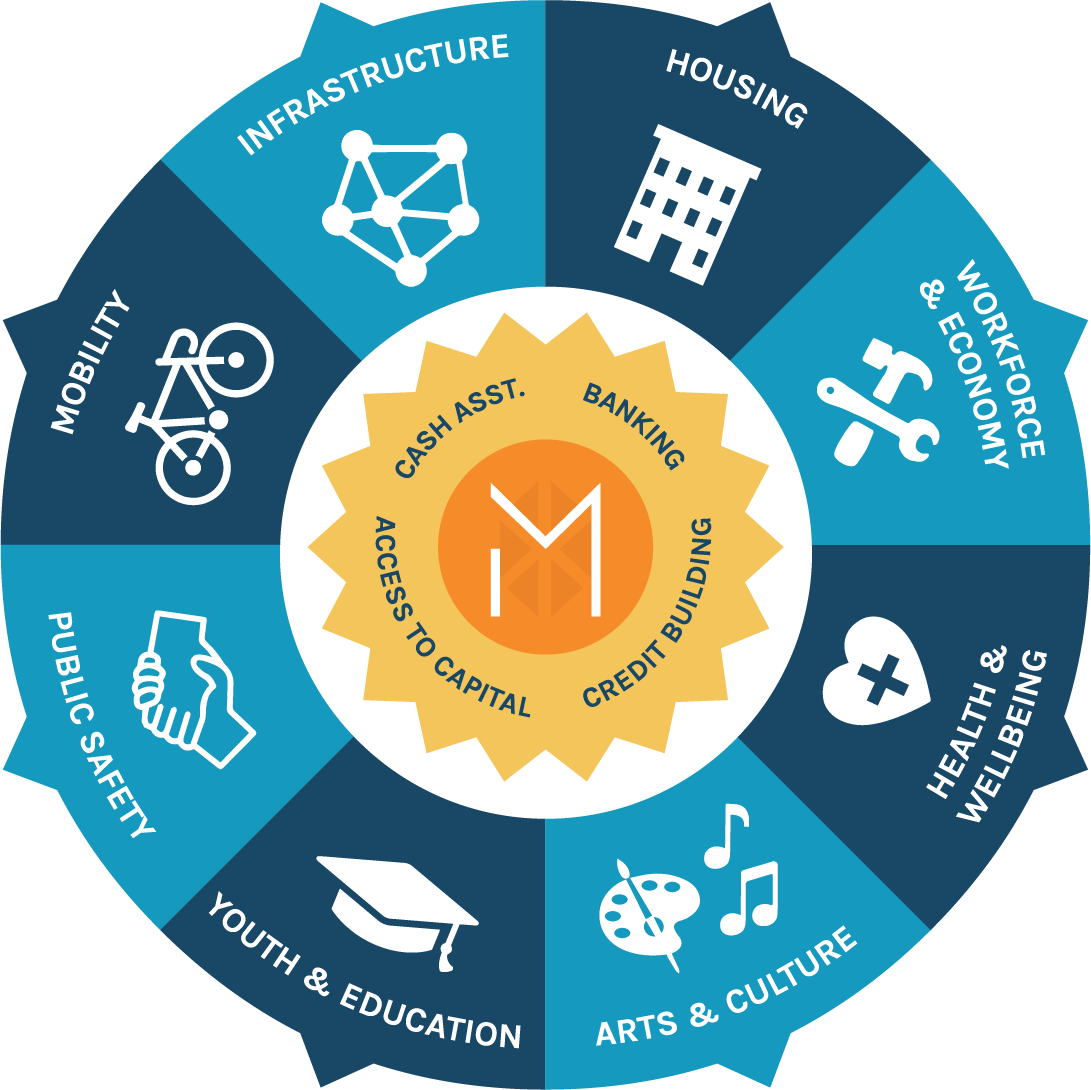

MoCaF’s financial services as infrastructure payments platform is an efficient digital disbursement tool for governments and non-profits. The platform’s self-service portal enables benefits providers to administer and monitor multiple programs via a self-service portal. MoCaFi’s Immediate Response Card prepaid debit card provides access to a fee-free ATM network, robust fraud prevention tools, multi-lingual customer service, and more.

The platform addresses a pain point for disbursing entities and benefits recipients, while contributing to the local economy. MoCaFi also connects benefits recipients to additional financial resources and information via our On Our Block community engagement strategy.

“MoCaFi has been an invaluable partner to the Community Investment for Families Department, allowing us to meet the needs of low-income Angelenos through various innovative financial empowerment programs with both efficiency and dignity.” – Aaron Strauss, Senior Project Coordinator, BIG:LEAP (Los Angeles Guaranteed Basic Income pilot)

Case Studies

MoCaFi’s platform has been utilized across the state for a variety of use cases, such as guaranteed basic income, emergency rental assistance, holiday food assistance, and more. Programs have served diverse recipients, from low-income families to unhoused individuals and community college students.

Case Study: Angeleno Connect, Los Angeles

The City of LA has contracted MoCaFi since 2020 as the payments platform for the Angeleno Connect Immediate Response Card and the Angeleno Bank Account. LA has used our platform successfully over the last 5 years as a tool to disburse funds to unbanked and underbanked Angelenos through various programs such as pandemic relief, emergency response, guaranteed basic income, emergency rental and utility assistance, holiday cash assistance, homelessness relief, and more. The program has served over 16,000 families to date.

Case Study: Direct Cash Transfer, Jewish Family Services San Diego

MoCaFi partnered with Jewish Family Services San Diego

to help disburse $9M in one-time cash payments of $4,000 to 2,250 program participants. The initiative provided financial assistance to those in need, supporting the organization in building a stronger, healthier San Diego.

“MoCaFi has been a professional and committed partner

in the disbursement of one of our largest cash transfer programs. Together, we provided critical funds that supported thousands of participants on their path to economic recovery. MoCaFi is a trusted partner, ensuring the payments were provided seamlessly, securely, and efficiently to all program participants.”

– Khea Pollard, Director of Economic Mobility & Opportunity, Jewish Family Services of San Diego

Case Study: On Our Block®

Over the last five years, we have learned that targeted community engagement is important to build trust and adoption in financial services. Deeply engaging with communities is core to MoCaFi’s mission. MoCaFi has hosted multiple events in California in partnership with local organizations, providing access to financial education, banking products, and 1-on-1 coaching. Through these events, MoCaFis has reached thousands of users in person and more online.

“I would absolutely recommend the MoCaFi event to my friends because I think financial literacy will allow us to remove some of the intergenerational traumas that have affected our community for many years. A lot of those traumas stem from financial illiteracy. Learning about how to take care of the little that I have has been a godsend for me.”

MoCaFi is proud to have served thousands of families in California over the last five years and looks forward to serving millions more in the future. Please reach out to schedule a demo or learn more about our services.